Like the rest of the world, Iceland saw a big drop in startup funding in 2023

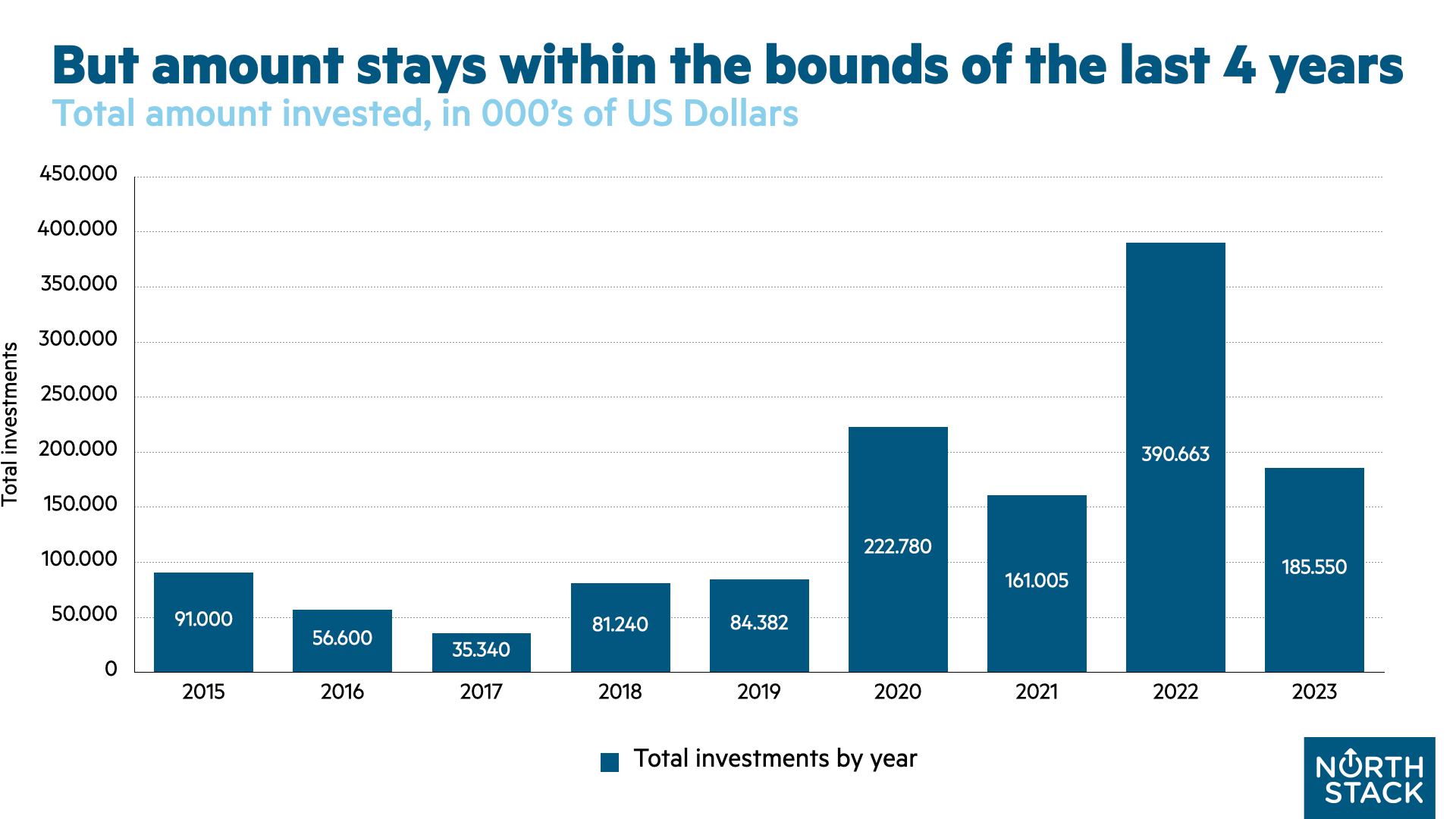

After an absolutely booming 2022, it's clear that the global venture slowdown hit Iceland, too. A big drop in deals compared to the previous five years, and although amounts dropped too, it's not as bad. Foreign participation remained incredibly strong, and — from a number of deals perspective — gender numbers looked better than before.

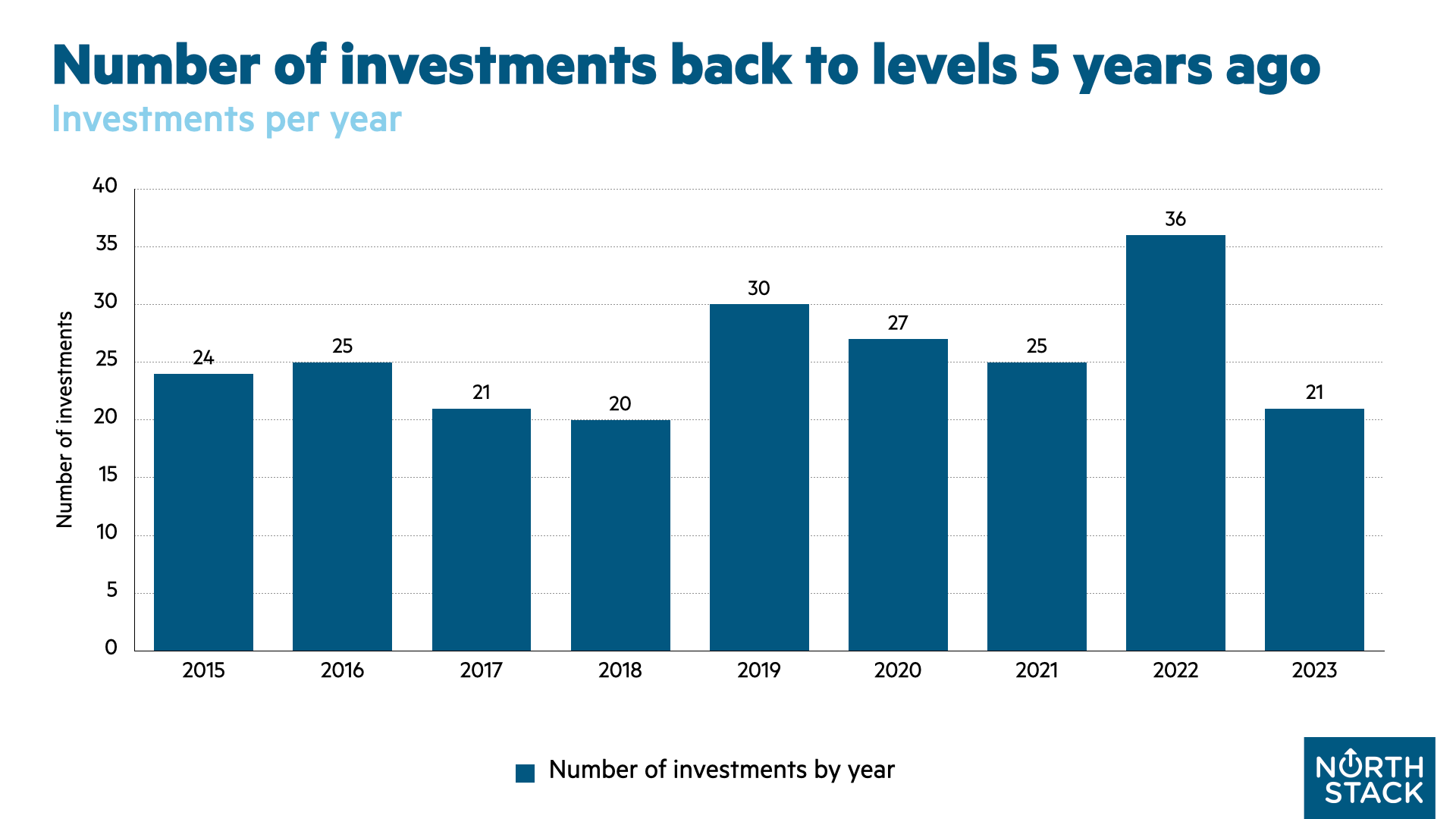

With 21 deals recorded, the number of deals we track is back to five years ago, after staying at or above 25 since 2019. This is not surprising, given the drop in venture deals around the globe.

Good news is, that even though compared to 2022 total invested dollars fell off a cliff and more than halved, the amount seems in line with both 2020 and 2021. The year 2022 will probably remain a complete outlier in terms of amounts invested.

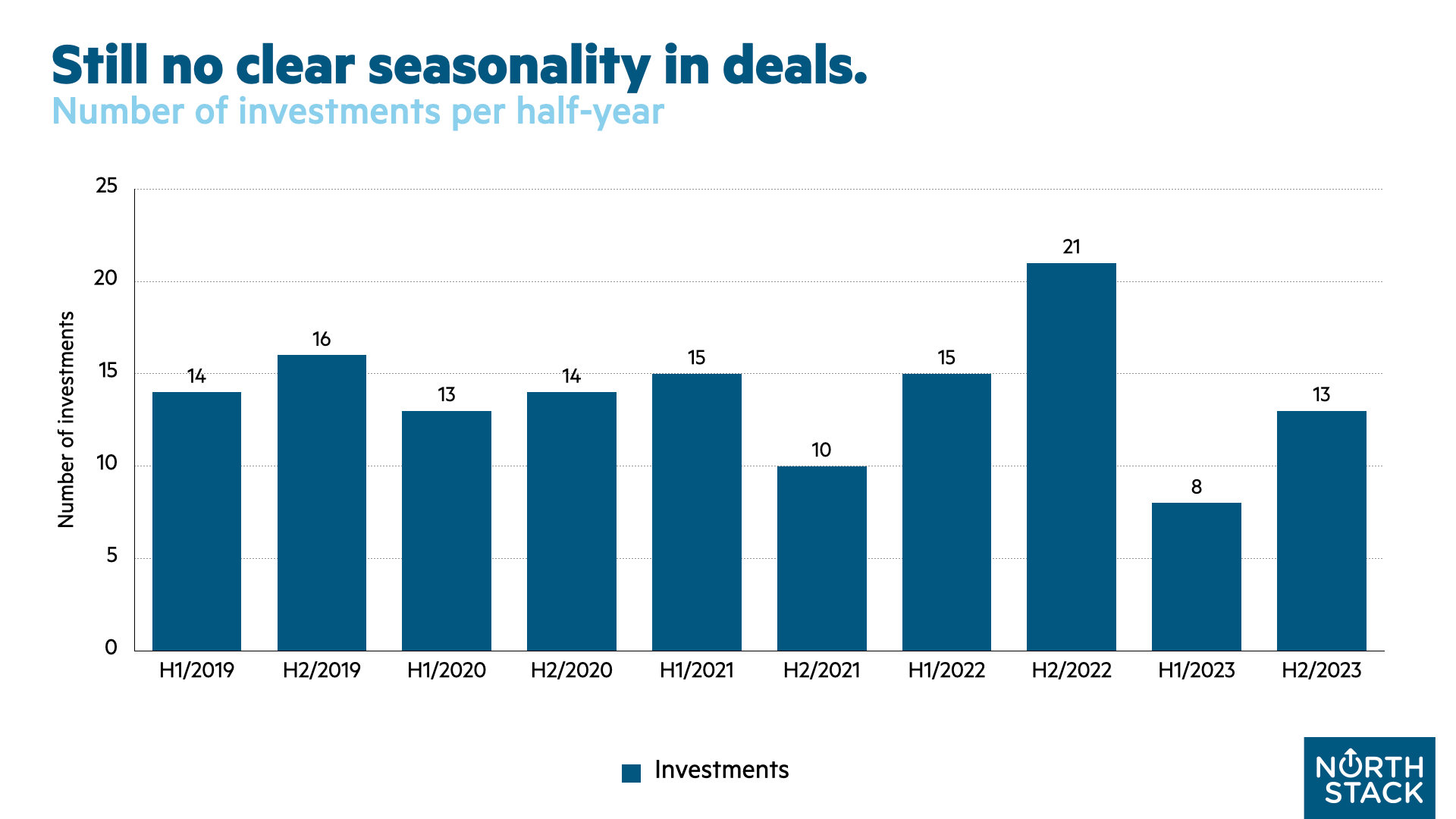

At some point we will stop reporting on this — seasonality. We don't see it. There's a glimmer of seasonality for the last two years, with second halves being considerably more active — but we won't call it a trend until it's three years in a row!

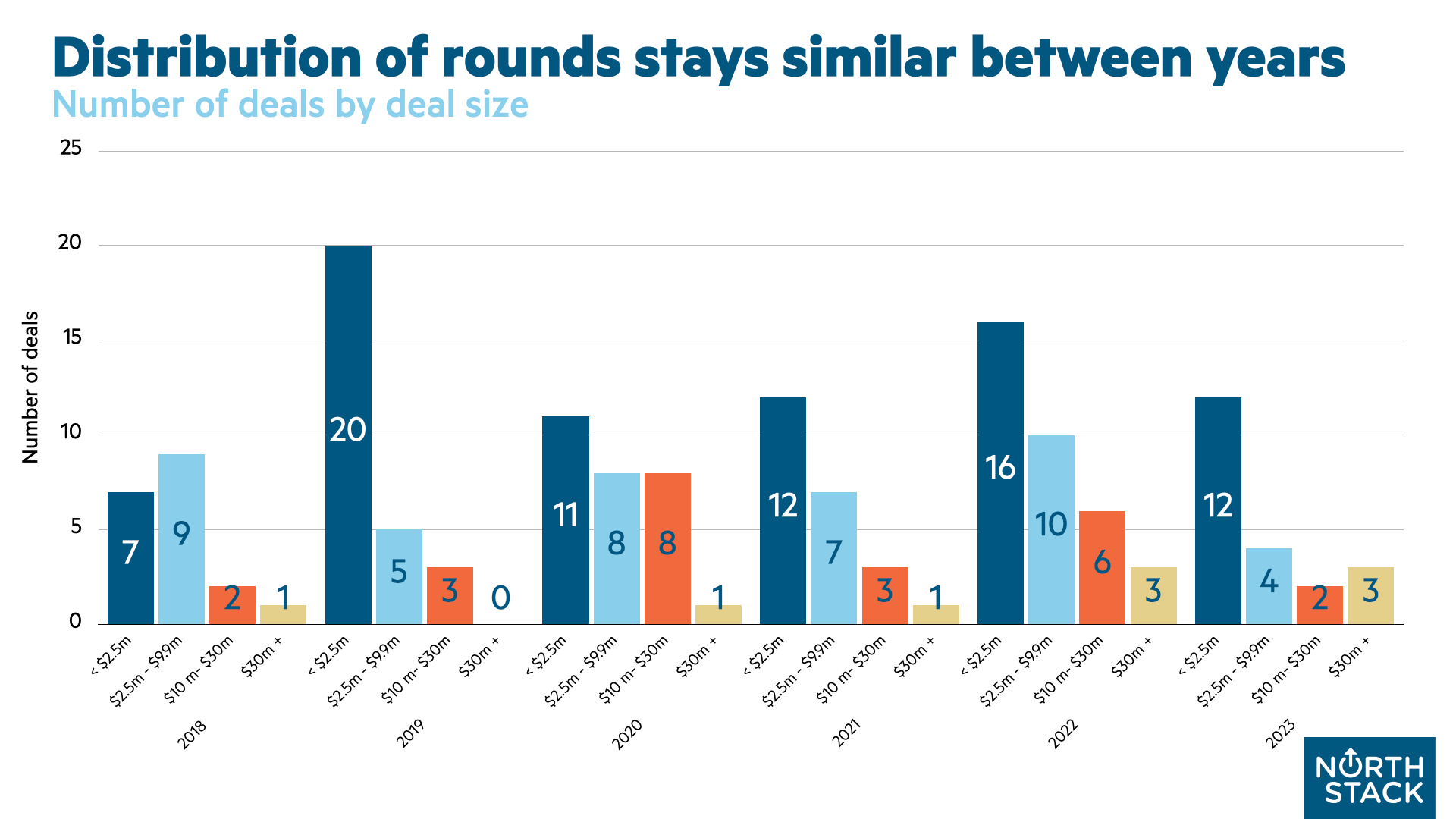

The graph for distribution between round sizes, which gives an indication to where in the lifecycle the companies are that are raising money, looks good — tall column on the left with the seed/pre-seed/post-seed/angel/some-new-name round suggesting decent early stage activity, with larger rounds also represented. We're not venture-capital ecosystem doctors, but if we were, we'd call this a healthy-looking distribution.

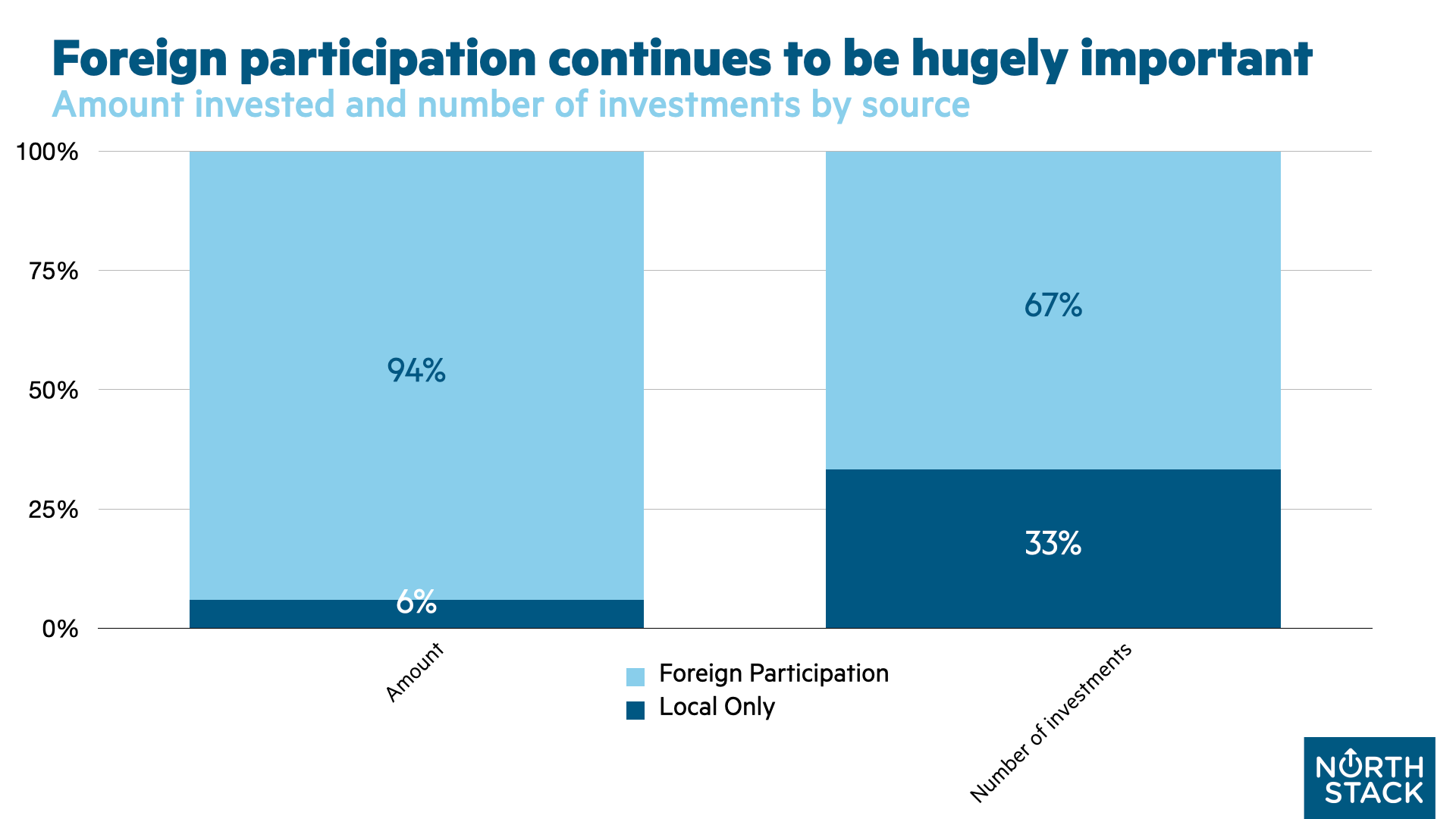

As usual, foreign participation is absolutely critical. Only 1/3rd of announced funding rounds didn't include foreign investors, and if we tally the rounds by amount sizes, 94% of funding rounds by amount included foreign investors. Note that we do not have insights into how much money came from abroad into the ecosystem.

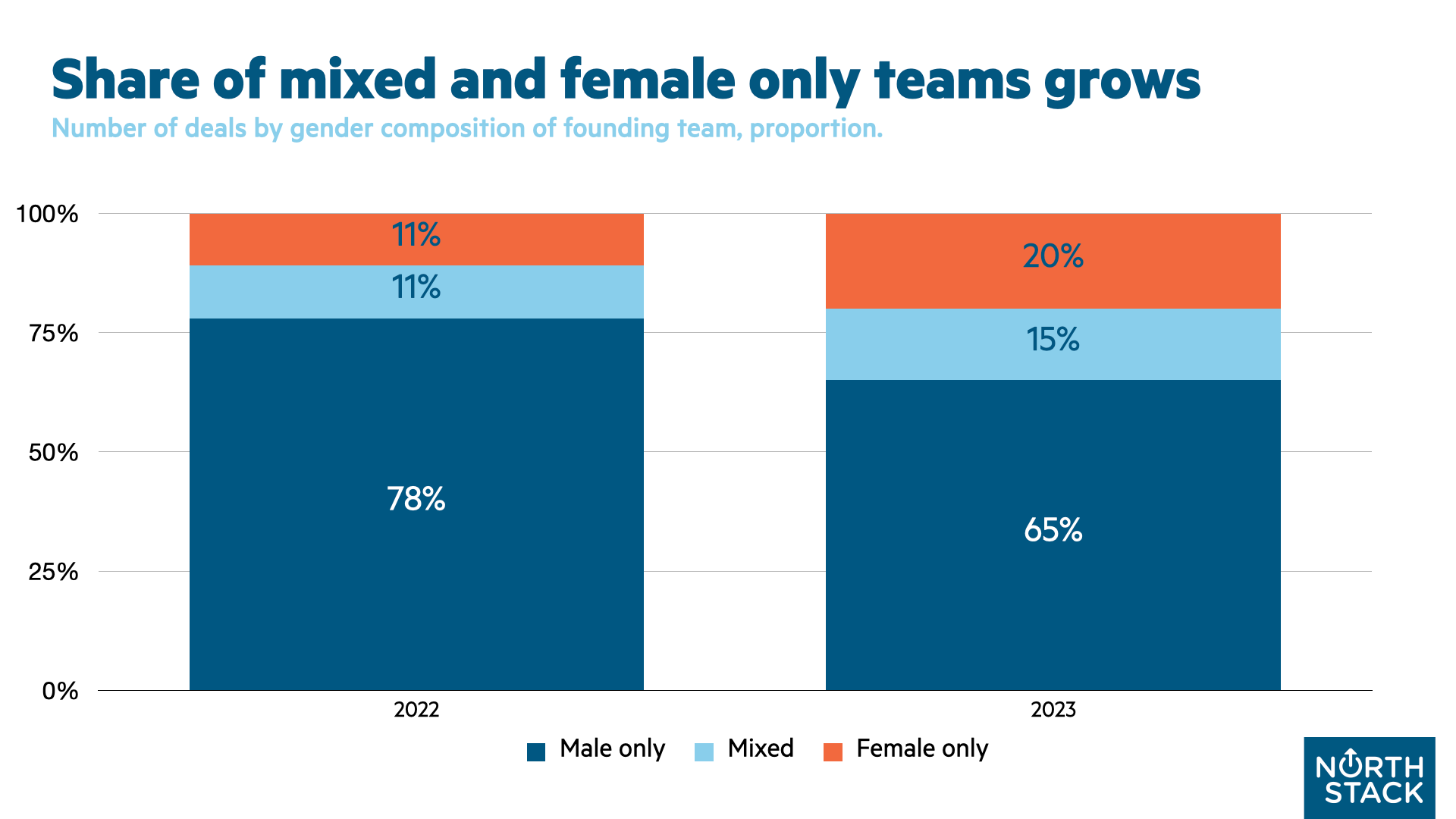

Ending on more of a positive note, share of mixed and female only teams raising increased by a good amount between the years.

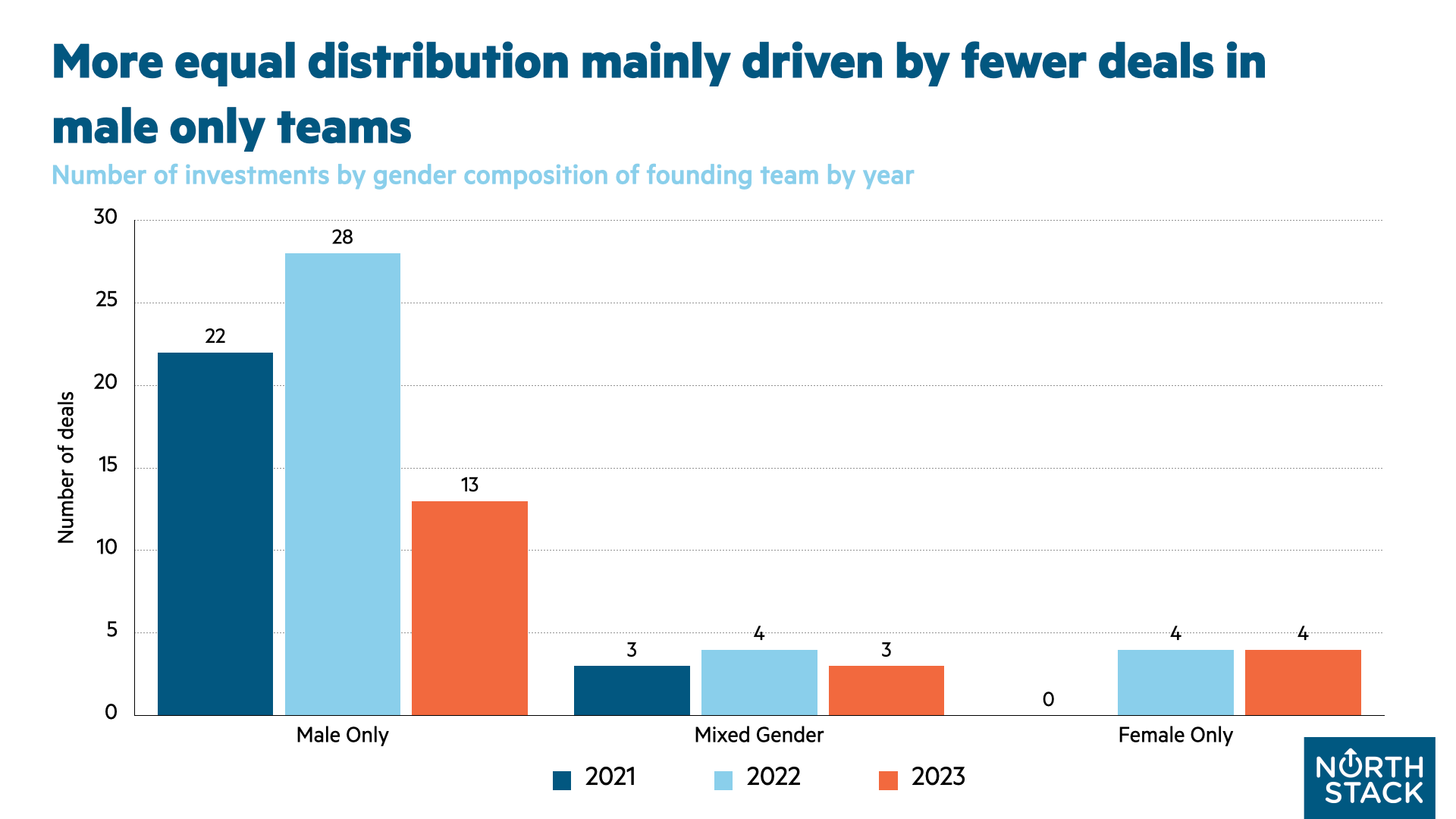

But the total number of deals going to mixed and female only teams doesn't change — the difference in share is explained by a massive drop in deals that include male only teams.

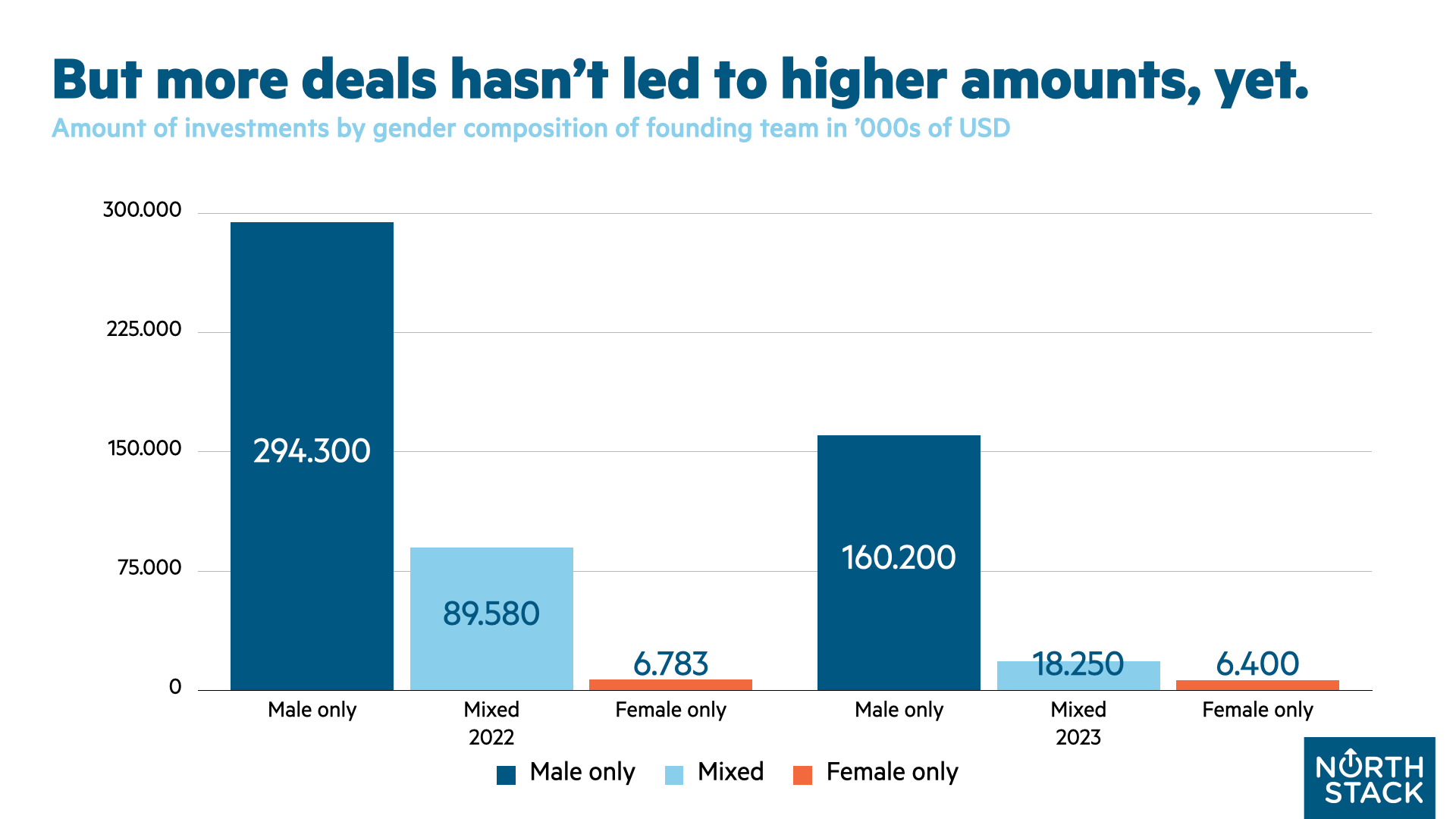

And even though we have more deals, the amounts going to mixed and female stayed low, suggesting that the mixed and female teams are mainly raising seed or other early stage type funding.

That is somewhat understandable. If for many years we had few deals and dollars flowing into mixed or female only teams, it will take several years to build up the number of startups led by mixed groups or women to show up in the larger investment rounds.

Notes on method and data

- We report on investments that are reported or public knowledge, and time them based on the official announcement dates (i.e. press releases). This is to maintain integrity between different platforms and years.

- We only count investments into companies that have operations in Iceland (i.e. if Icelandic VC’s invest in companies that are fully abroad, we don’t count those in this report; nor do we track investments into Icelander founded companies that are located abroad).